Singapore Market Update :

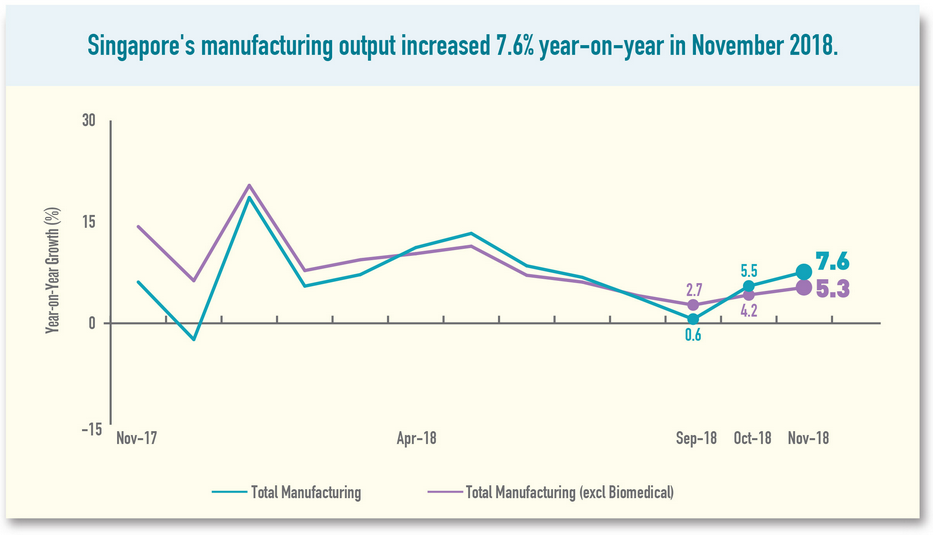

Singapore's manufacturing yield expanded 7.6% in November on a year-on-year premise, announced the Economic Development Board (EDB) on Wednesday.

Barring biomedical manufacturing , yield became 5.3%. On a three-month moving normal premise, producing yield rose 4.5% in November 2018, contrasted with a year prior.

On an occasionally balanced month-on-month premise, fabricating yield expanded 2.8%. Barring biomedical assembling, yield was unaltered.

Yield for biomedical assembling expanded 18.5% in November from a year back. Pharmaceuticals yield extended 23.9% with higher generation of dynamic pharmaceutical fixings and organic items, while the medicinal innovation section became 6.6%.

Yield for transport designing expanded 11.3% year-on-year with all sections recording yield development. The marine and seaward designing portion extended 26.6%, on the back of a low base in November a year ago, and in addition a more elevated amount of work done in seaward ventures. The land and aviation portions became 4.7% and 0.6% individually.

For the gadgets part, yield expanded 11.2% in November on a year-on-year premise. Inside the bunch, the semiconductors, infocomms and buyer hardware and other electronic modules and segments sections became 16.5%, 12.6% and 3.0% individually. Then again, the information stockpiling and PC peripherals sections contracted.

Yield for synthetic concoctions expanded 3.4% year-on-year in November. Development was bolstered by alternate synthetic concoctions and claims to fame portions which became 18.7% and 6.6% individually. The previous detailed higher yield in aromas while the last enrolled higher yield in modern gases and mineral oil added substances. On the other hand, creation in the oil and petrochemicals portions fell 5.3% and 10.9% individually, because of support shutdowns.

Yield from general assembling diminished 0.8% on a year-on-year premise in November. The sustenance, refreshments and tobacco and various ventures fragment became 1.0% and 0.3% individually. Then again, the printing portion declined 11.0%.

Yield from exactness designing declined 8.2% in November contrasted with a year back.

Epic Research is a leading SGX stock advisory company which provides stock signals, SGX trading tips for SGX stocks, SGX Exchange, SGX Singapore. Call +6531581402 to know more.